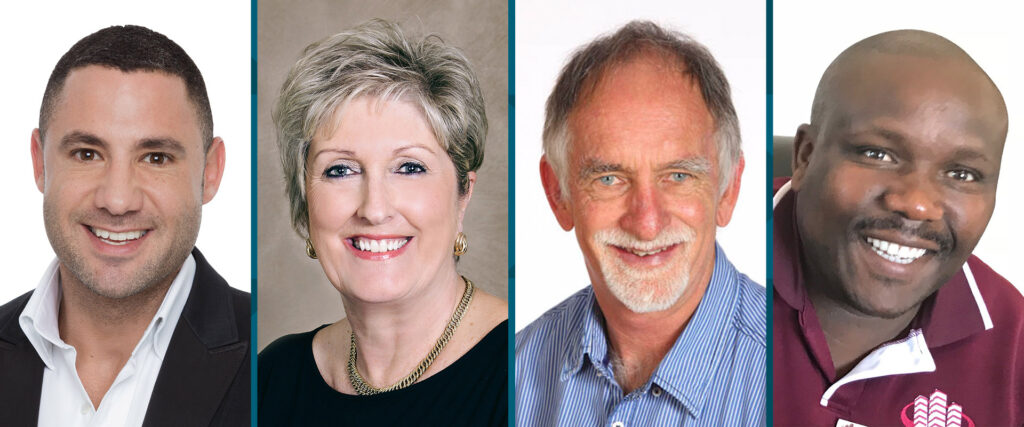

MAIN IMAGE: Ross Levin, managing director for Seeff Atlantic Seaboard and City Bowl; Caron Leslie, broker/owner RE/MAX Tableview; John Birkett, co-franchisee of Rawson Properties Claremont; Zola Mekula, owner/principal Zolam Properties.

While it’s true that Cape Town’s luxury property markets are under pressure, it’s not all doom and gloom as there are still excellent deals being done. Here’s why luxury property remains an excellent long-term investment option.

The Atlantic Seaboard has for years been one of Cape Town’s premier property areas but of late house price growth has been under pressure. According to FNB’s August Property Barometer house price growth in this sub-region remains in the negative as is also the case for upmarket homes in the City Bowl area and the Southern Suburbs.

FNB economist Siphamandla Mkhwanazi says deflation has become a common theme across the affluent suburbs in the country. So much so that the investigative journalism TV show Carte Blanche recently aired a programme on this issue probing whether investing in luxury property was still a good idea in areas such as the Atlantic Seaboard or elsewhere in South Africa. Their conclusion was that while luxury properties have been under pressure over the last 3-5 years to grow in value, there is excellent investment opportunities in the lower-priced property range.

Mkhwanazi states the same namely that Cape Town’s lower-priced regions, which includes the township areas, are showing double digit house price growth. Their latest data shows that the Elsies River/Blue Downs/Macassar region has done very well in the first half of the year making it the city’s best performing sub-region.

Commenting on the above, property specialists from the Cape’s Atlantic Seaboard and other upmarket areas disagree with the negative outlook on the luxury market saying though sales are down compared to previous years, excellent sales are still being done.

“As the country’s premier real estate market with the highest prices, it should be no surprise that the general economic downturn has put pressure on prices across the Atlantic Seaboard and City Bowl area. We have seen that in some areas, sales volumes had dipped to some of the lowest levels experienced over the last five years, but we are still doing excellent deals daily,” says Ross Levin, director for Seeff Atlantic Seaboard and City Bowl.

Caron Leslie, broker/owner of RE/MAX Tableview, says it has always taken longer for homes to sell in the upper price range and listings often remain on the market for 12 months. However, they recently had a sale of R20 million to a local buyer after the property had only been on the market for a few weeks. Susan Watts, broker/manager for RE/MAX Living, says they operate in the exact market that Carte Blanche spoke about, the luxury property market, and, while down, there have been sales above R10 million and some for far more this year. She says 17 of their own mandates were sales to foreign buyers from Europe, the United Arab Emirates and Canada. “Buyers are still looking, they are just hungry for bargains,” she said.

Also read: Good news for buyers as upmarket house prices drop in Cape Town

It is however also true that Cape Town’s upmarket property prices were driven to record highs in the last decade or so making the area one of the most expensive in the country. Sellers and estate agents drove prices up says John Birkett, co-franchisee of Rawson Properties Claremont who has been selling properties in the Rondebosch area for 20 years. “The market is experiencing a long-awaited correction, simply because the market has been driven by price not by value,” he says. Birkett agrees with FNB’s observation that the highest current demand for housing is in low-cost housing because there is a need.

“Of course,” says Zola Mekula, owner and principal of Zolam Properties, one of the biggest estate agencies in Khayelitsha, “most of the people who need houses are blacks and they can only afford properties in the so-called black areas”.

But besides the need for affordable housing, black property investors has also discovered the value of owning a property with enough space to build flatlets that can bring in rental income. “It is a booming business in Khayelitsha,” Mekula says. If such a property becomes available in Ilitha Park, a late 90’s housing development in Khayelitsha, it sometimes doesn’t even take 24 hours to sell the property he says. He has such a property, a 2-bedroomed house, on sale now for R780 000 – in an area where these houses were initially sold for between R40 000 and R60 000.

Why Cape Town remains a good property investment

The view from a R65 million home in Clifton on the Atlantic Seaboard.

The abundance of stock on offer and the flat price growth means this is an excellent time to buy in Cape Town, says Samuel Seeff, chairman of the Seeff Property Group. Cape Town remains one of the best areas to invest in for a number of reasons:

- It is still the best run metro in the country and continues to garner international awards

- It is arguably one of the top tourist cities on the continent and one of the most sought-after in the world and will continue to be in demand for property, attracting a broad spectrum of buyers, from locals to other inland buyers as well as buyers from elsewhere on the continent and from abroad (buyers from just about every continent and well over 30 countries have invested in property in sought-after areas such as the Atlantic Seaboard and City Bowl over the last 10 years)

- It remains a top performing market, even under the challenging conditions and has delivered outstanding capital growth during the 2013-2017 market upswing

- The location is simply world-class, the views, the lifestyle, the fabulous climate, yet you can still buy a lot more for your Dollar, Pound or Euro in Cape Town

The important take-out from the various property commentators and indices should be that, rather than viewing the market with an air of gloom and doom, it should be seen as an excellent time to buy, perhaps one of the best times in decades, the favourable interest rate and bank lending climate and flat price growth, all providing reasons for buyers to start taking advantage of the market conditions. Seeff concludes.

Says Berry Everitt, CEO of the Chas Everitt International property group: “Estate agents often get teased for being “super-optimists” who keep telling people to buy property, rain or shine, in good times and in bad, upcycles and downswings.

“However, this is actually no laughing matter. It is in fact always a good time for someone to be buying property – even when the economy isn’t growing and the media is making much of slow sales and lower asking prices in the luxury property sector.

“In short, in real estate as in equities, the best time to take a risk and buy is always when everyone else is selling, and vice versa. This means, unfortunately, that now is not such a great time to be a seller, unless you are planning a substantial upgrade.

“It does not mean, however, that sales are not taking place. It is still perfectly possible to sell your home, especially with the assistance of a qualified and experienced agent who will help you to set the correct asking price and pre-qualify prospective buyers to ensure that they are able to afford the property and obtain a home loan.

“What is more, if optimism was as contagious as the negativity we are all so good at, the market would already be flying – and many people would be kicking themselves for having missed out on the opportunities it currently offers. I say it’s time to get moving before it’s too late.”